How BillingHub360 Simplifies Organizing Your Expenses for a Stress-Free Tax Filing

Introduction

As a small business owner, especially in the trades, the pressure of managing expenses can be overwhelming—especially when tax season rolls around. The last thing you want is to sift through piles of receipts and spreadsheets, stressing over lost deductions. Fortunately, BillingHub360 is here to simplify your financial organization, ensuring a stress-free tax filing experience.

The Importance of Organizing Expenses

Understanding your expenses is crucial for any entrepreneur. Not only does it help in maintaining accurate financial records, but it also maximizes your tax deductions. Here's why organizing your expenses matters:

- Reduces Stress: A well-organized system minimizes anxiety during tax season.

- Maximizes Deductions: Proper documentation allows you to claim all eligible expenses.

- Improves Financial Insight: Tracking expenses helps you make informed business decisions.

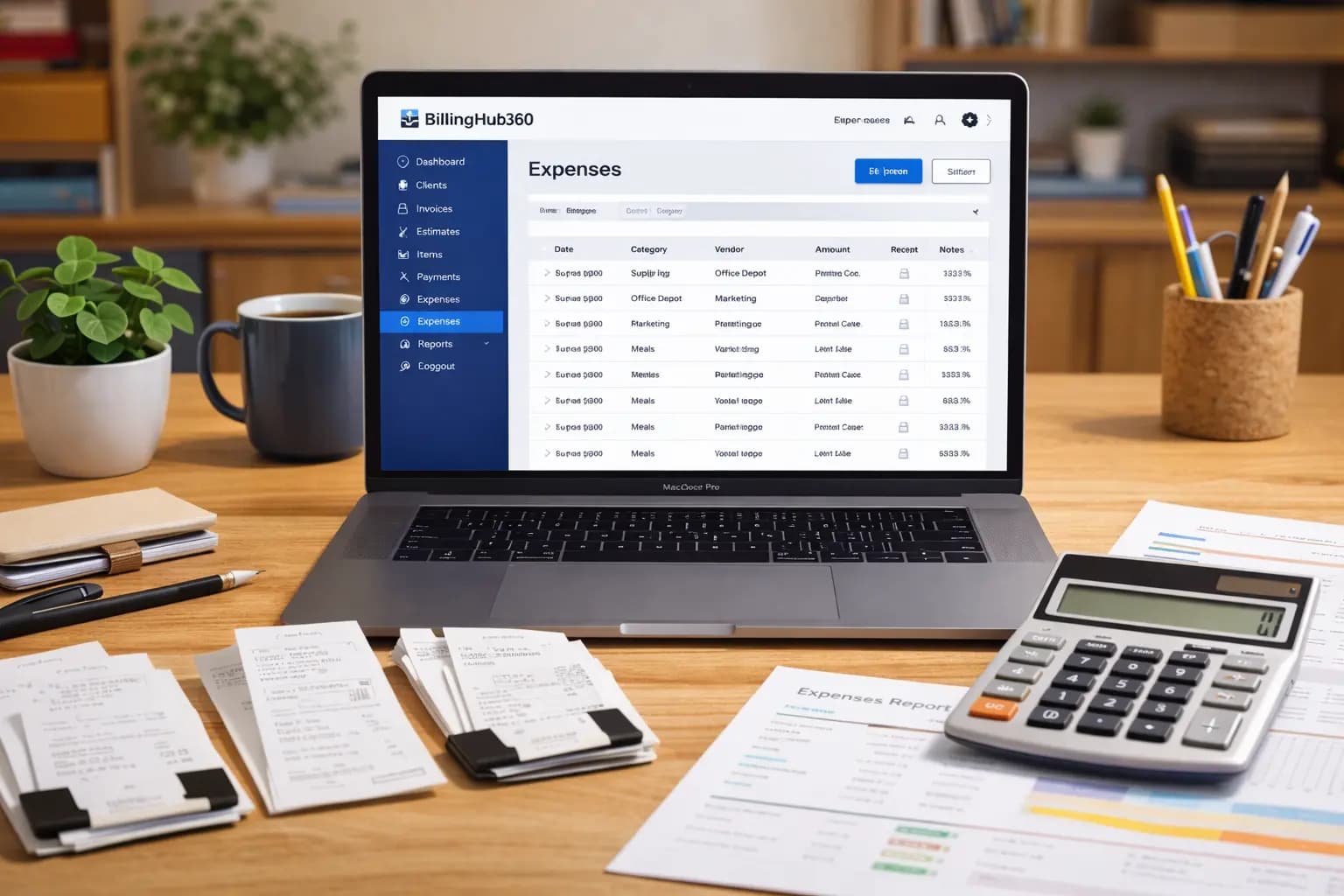

How BillingHub360 Makes Expense Organization Effortless

BillingHub360 is specifically designed for small service businesses, providing tools that streamline the expense tracking process. Here's how it can help you:

1. Automated Expense Tracking

No more manual entry or lost receipts! With BillingHub360, you can automate your expense tracking. Simply link your bank accounts and let the software categorize transactions for you. This saves time and minimizes errors.

2. Receipt Scanning and Storage

Gone are the days of keeping paper receipts in a shoebox. With BillingHub360’s receipt scanning feature, you can take pictures of your receipts and store them digitally. This not only organizes your expenses but also ensures that you have proof of every transaction when tax season arrives.

3. Real-Time Expense Reports

BillingHub360 provides real-time insights into your expenses through customizable reports. You can monitor where your money is going, allowing you to adjust spending habits as needed. This transparency is invaluable for making data-driven decisions.

4. Tax Preparation Made Simple

When tax season comes, BillingHub360 prepares your financial records in a way that is easy to understand and ready for your accountant. The software generates a detailed summary of your expenses, categorized according to IRS guidelines, making it simple to complete your tax return.

5. Secure Cloud Storage

Your financial information is sensitive, and BillingHub360 prioritizes security. With cloud storage, you can access your data from anywhere while keeping it safe from unauthorized access. This peace of mind is crucial for any business owner.

Tips for Using BillingHub360 Effectively

To get the most out of BillingHub360, consider these practical tips:

- Regularly Update Your Records: Make it a habit to update your expenses regularly instead of waiting until tax season.

- Utilize Categories: Take advantage of the categorization features to organize expenses by project or type.

- Review Reports Monthly: Regularly review your expense reports to stay informed about your financial health.

Conclusion

As a Latino entrepreneur or tradesperson, managing your business finances is essential for growth and success. BillingHub360 offers a user-friendly solution to simplify your expense organization, making tax filing less stressful and more efficient. By leveraging its features, you can focus more on growing your business and less on paperwork. Start using BillingHub360 today and experience the peace of mind that comes with organized finances!

Comments (0)

No comments yet. Be the first to share your thoughts!